The Culture of Finances

The Culture of Finances is a diverse community outreach program that supports, develops, and encourages financial growth through tailored education courses.

These courses provide personalized financial education, address systemic disparities, and aid in conquering financial fears. The goal of this program is for participants to achieve financial confidence, preparedness, and receive the tools to reach their financial dreams.

• Provides courses to the underserved in our community.

• Focuses on increasing financial success for attendees.

• Provides equal access to opportunities and resources.

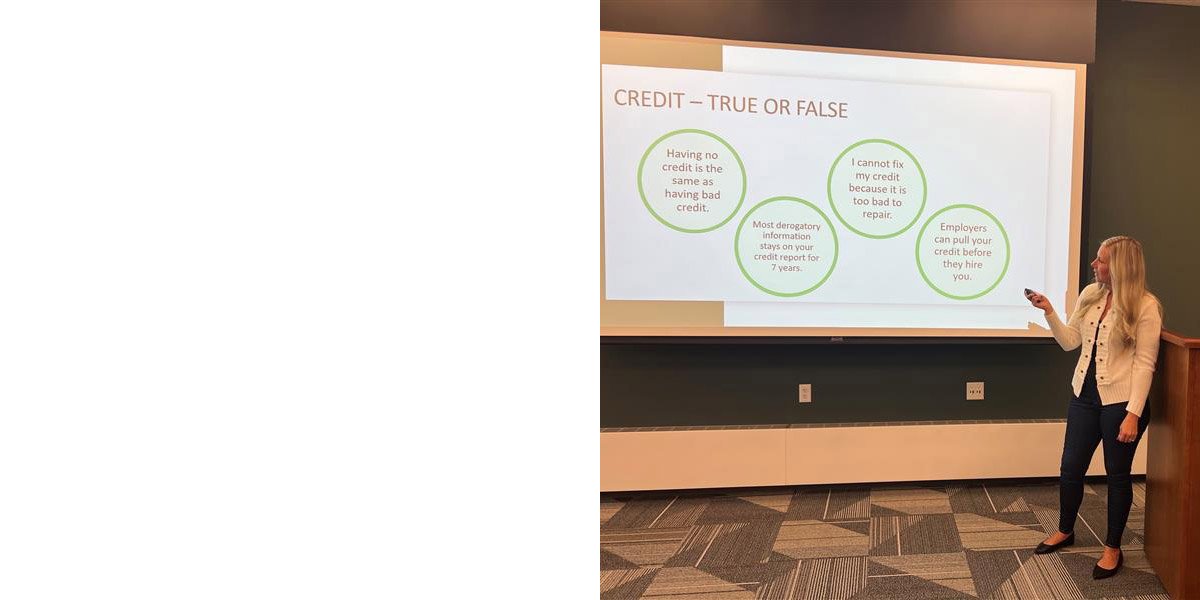

When you join The Culture of Finances, you'll be provided the tools for financial success, learn about credit, debt management, and more.